Buy Now, Pay Later (BNPL) providers like Affirm, AfterPay, and Klarna generated a lot of press over the past year as consumers looked for ways to make it easier to buy what they wanted without incurring more credit card debt. Recent developments include:

- Amazon and Affirm partnered. Amazon shoppers will be able to split purchases of $50 or more into smaller, monthly installments. Affirm said some loans will come with 0% APR, while others will bear interest.

- PayPal will stop charging late fees on BNPL payments. Since its launch, more than 7 million consumers have used PayPal’s BNPL service, purchasing more than $3.5 billion of products.

- Square acquired AfterPay. The deal will bring AfterPay’s merchant relationships into Square’s seller ecosystem and help to convert AfterPay’s existing customer base into Cash App users.

- Apple announced a BNPL offering. Apple Pay users will be able to make interest-free BNPL purchases, choose any credit card to make the payments, and avoid late and processing fees with certain plans.

- Buy Now, Pay Later to Reach $100 Billion in 2021

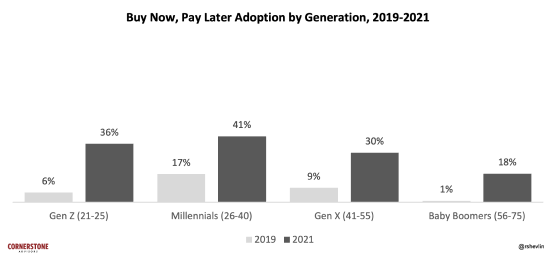

- The percentage of Gen Zers in the US using BNPL has grown six-fold from 6% in 2019 to 36% in 2021. Millennials’ use of BNPL has more than doubled since 2019 to 41%. Gen Xers’ adoption more than tripled, and even Boomers are getting into the act.

Overall, consumers will make nearly $100 billion in retail purchases using BNPL programs in 2021—up from $24 billion in 2020, and $20 billion in 2019.